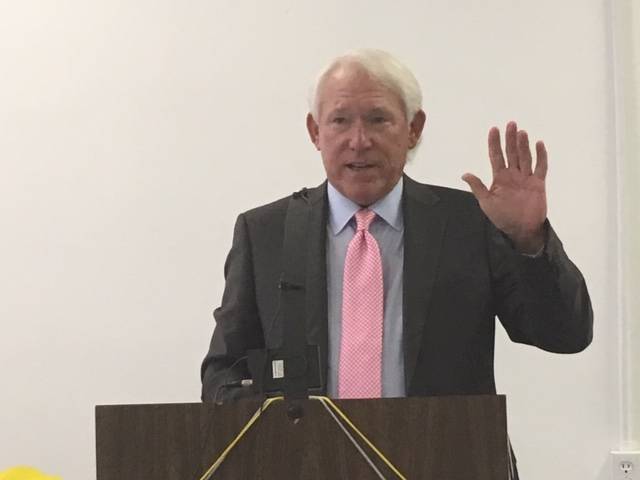

LAURINBURG — The local Rotary Club got a crash course in investment banking Tuesday when Frank Golden, a 40-year veteran of the securities industry and now manager of Wells Fargo advisors spoke to the group.

Golden spent time hitting on such topics as the tariffs, economic forecast and even the affects of mid-term elections on the markets. But what seemed to resonate with the crowd was his discussion of how China, specifically, is dealing with President Trump’s tariffs on imports.

“China is a big dog out there, but we seem to be doing a lot better (under the tariffs) than they are,” Golden said. “And the deals we’ve made with Canada and Mexico are making it even tougher on China.”

He added that it appears investors are backing away from China’s manufacturing industry — but the Asian country has shifted gears and its real estate market is driving the economy.

“They have no property take there, and they know they have to keep their real estate market strong,” Golden said. “But they also know they will need to get their manufacturing industry going again.”

He added that China likely will sell off some of the debt they purchased from the United States, and that it’s a good bet the U.S. will be major buyers when that happens.

“It’d be a big win for us financially,” Golden said.

In other areas, Golden said the national S&P market has increased from 666 points to 2,941 points since 2009. But now stocks are fully priced, which makes the markets more volatile.

“When you have a market going up like that for so long, there’s not much volatility,” he said. “Now the fluctuation is kicking in — fueled by things like Italy’s economy, the feds talking interest rates, tariffs and the even the Kavanaugh hearings.”

Golden told the Rotarians that 70 percent of household debt is wrapped up in mortgages; that, since 2015, people are saving more than they are borrowing; that experts don’t see a recession on the horizon; and that the Amazon Effect is keeping a lot of inventory out moving quickly — all of which is good for the country.

“I still see plenty of room for the economy to grow,” Golden said. “It won’t grow at the rate we’ve seen lately, but there should still be growth.

“Could something go wrong? Of course,” he added. “Things like the feds miscalculating or the trade war or China putting the brakes on its own stimulus plan.”

In the area of mid-term elections, Golden said since 1926, the markets have risen by an average of 13 percent afterward — compared with presidential elections where markets have risen by an average of 6 percent.

“That’s because we often see more spending programs — and of the GOP keeps both houses in Congress, they may make the tax cuts permanent rather than expire in 2025,” he said. “We think the Democrats may get the House and Republicans keep the Senate — which is good for the markets because they won’t get anything done.”

Golden wrapped up by telling the crowd his favorites in the stock market are financial stocks and those in the international markets. But he also gave a piece of advice for investors.

“Stay diversified and stay patient and you should be fine,” he said.

W. Curt Vincent can be reached at 910-506-3023 or [email protected].